Investing in gold and silver has lengthy been thought to be a strategic monetary decision, notably during occasions of financial uncertainty. As tangible assets, these treasured metals have intrinsic worth and have been used as a retailer of wealth for centuries. This text examines the rationale behind investing in gold and silver, their historical significance, market dynamics, and the assorted methods of investment obtainable to potential buyers.

Historical Context of Gold and Silver Funding

Gold and silver have been valued by civilizations for thousands of years. Gold, usually associated with wealth and prestige, was historically used as forex and a medium of change. Silver, whereas additionally precious, has been extra commonly utilized in industry, particularly in electronics and photography. The historic context of those metals reveals their enduring enchantment and the the reason why they proceed to attract buyers in the present day.

During financial downturns, investors often flock to gold and silver as safe-haven property. The 2008 financial disaster, for example, saw a big improve in gold prices as traders sought refuge from declining inventory markets and unstable currencies. This sample has repeated itself during current world uncertainties, including the COVID-19 pandemic, which has led to heightened demand for these metals.

The Financial Rationale for Investing in Precious Metals

The first reasons for investing in gold and silver can be categorized into several key components:

- Inflation Hedge: Valuable metals are sometimes considered as a hedge in opposition to inflation. As the value of fiat currencies erodes over time on account of inflationary pressures, the purchasing energy of gold and silver tends to remain stable or enhance. This characteristic makes them engaging to buyers looking to preserve their wealth.

- Diversification: Including gold and silver in an funding portfolio can improve diversification. Treasured metals often have a low correlation with different asset classes, such as stocks and bonds. Which means during durations of market volatility, gold and silver could not comply with the same trends as equities, providing a buffer in opposition to losses.

- Geopolitical Stability: In occasions of geopolitical uncertainty, investors often flip to gold and silver as a safe haven. Political instability, trade wars, and conflicts can lead to market fluctuations, prompting traders to seek the stability supplied by valuable metals.

- Supply and Demand Dynamics: The supply of gold and silver is comparatively fastened, as new discoveries and mining operations take time and investment. Conversely, demand for these metals continues to develop, driven by each investment and industrial applications. This imbalance can lead to price appreciation over time.

Market Dynamics of Gold and Silver

The costs of gold and silver are influenced by a variety of things, including market sentiment, curiosity charges, and currency fluctuations. The connection between gold prices and interest charges is particularly vital; when curiosity charges are low, the opportunity value of holding non-yielding assets like gold decreases, often resulting in larger demand and prices.

Additionally, the power of the U.S. dollar performs a major role within the pricing of gold and silver. A weaker dollar sometimes leads to larger gold costs, as these metals are priced in dollars on the global market. Conversely, a powerful dollar can suppress costs.

Strategies of Investing in Gold and Silver

Investors have several choices on the subject of investing in gold and silver, each with its personal advantages and disadvantages:

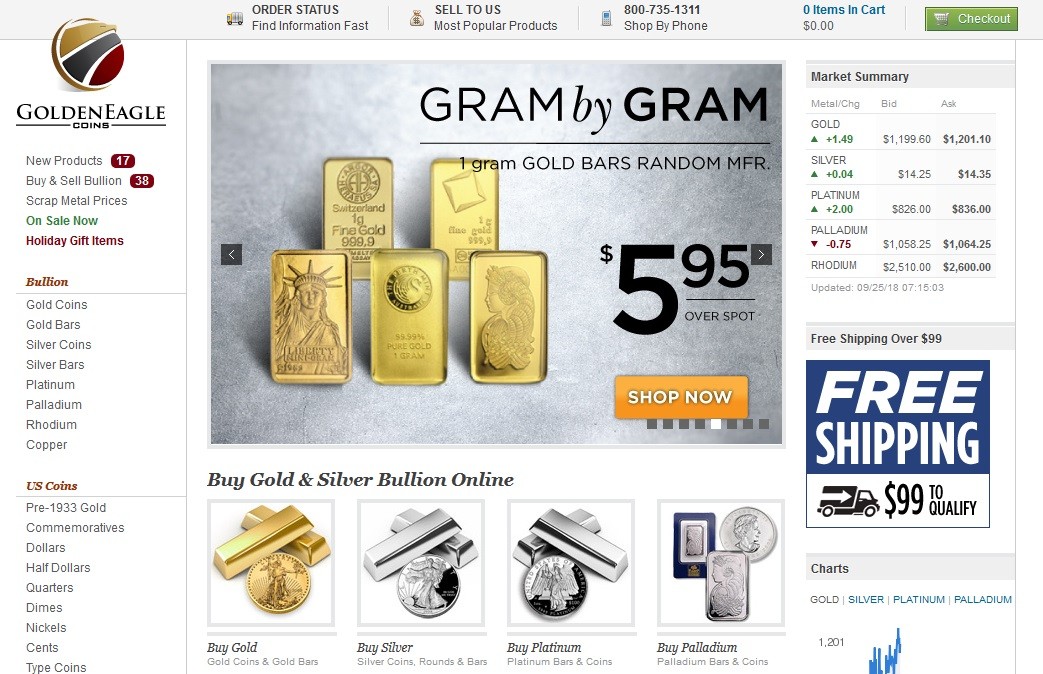

- Bodily Metals: Buying physical gold and silver, reminiscent of coins or bullion, is some of the direct methods of investment. Whereas this strategy permits for tangible possession, it also requires safe storage and insurance coverage, which can incur further costs.

- Trade-Traded Funds (ETFs): Gold and silver ETFs offer a convenient option to spend money on treasured metals without the necessity for physical storage. These funds monitor the price of the metals and could be bought and offered like stocks on an alternate. If you have any kind of concerns relating best companies to buy gold from where and ways to utilize best place to buy silver and gold online, you could call us at our own site. However, traders should be aware of administration fees related to these funds.

- Mining Stocks: Investing in firms that mine gold and silver can present publicity to these metals without direct ownership. Mining stocks can provide leveraged returns; nonetheless, they also include further risks related to operational performance and market conditions.

- Futures and Options: For more experienced buyers, trading gold and silver futures or options can be a option to speculate on price movements. These financial instruments enable investors to leverage their positions but in addition carry a better threat of loss.

- Digital best online gold buying site: With the rise of technology, digital gold platforms have emerged, allowing buyers to buy and sell gold in a digital format. These platforms often provide liquidity and ease of access however may additionally involve fees and counterparty risks.

Risks and Considerations

Whereas investing in gold and silver can offer numerous benefits, it is crucial to contemplate the related risks. The costs of treasured metals will be unstable, influenced by a range of economic indicators and market sentiments. Additionally, the lack of income era from holding gold and silver implies that investors may miss out on potential returns from different asset courses.

Investors ought to even be wary of scams and counterfeit merchandise when purchasing physical metals. It is essential to deal with reputable dealers and conduct thorough analysis before making any funding.

Conclusion

Investing in gold and silver presents a singular alternative for people looking for to diversify their portfolios and hedge in opposition to financial uncertainty. With a rich historic context and a compelling economic rationale, these treasured metals proceed to attract investors worldwide. By understanding the market dynamics and various funding strategies, individuals could make knowledgeable decisions that align with their monetary goals. As all the time, it's advisable to conduct thorough research and consider personal risk tolerance earlier than venturing into the world of treasured steel investments.