Lately, the monetary landscape has undergone vital adjustments, particularly in how lenders strategy long-term personal loans for people with dangerous credit. Traditionally, those with poor credit histories faced steep challenges in securing loans, often leading to exorbitant curiosity rates or outright rejections. However, a new wave of financial merchandise and innovative lending practices is emerging, aimed toward bettering access to credit for this underserved population. This article explores the demonstrable advances in lengthy-time period personal loans for bad credit in ny loans for bad credit, highlighting key tendencies, technological improvements, and the implications for borrowers.

Understanding the need for Lengthy-Term Personal Loans

Long-term personal loans are typically outlined as loans with repayment periods extending beyond three years. For individuals with bad credit, these loans can function an important monetary useful resource, providing the chance to consolidate debt, cowl unexpected bills, or finance important life events. However, the traditional lending mannequin usually discriminated against those with decrease credit scores, leaving many without viable options.

Advances in Credit Evaluation

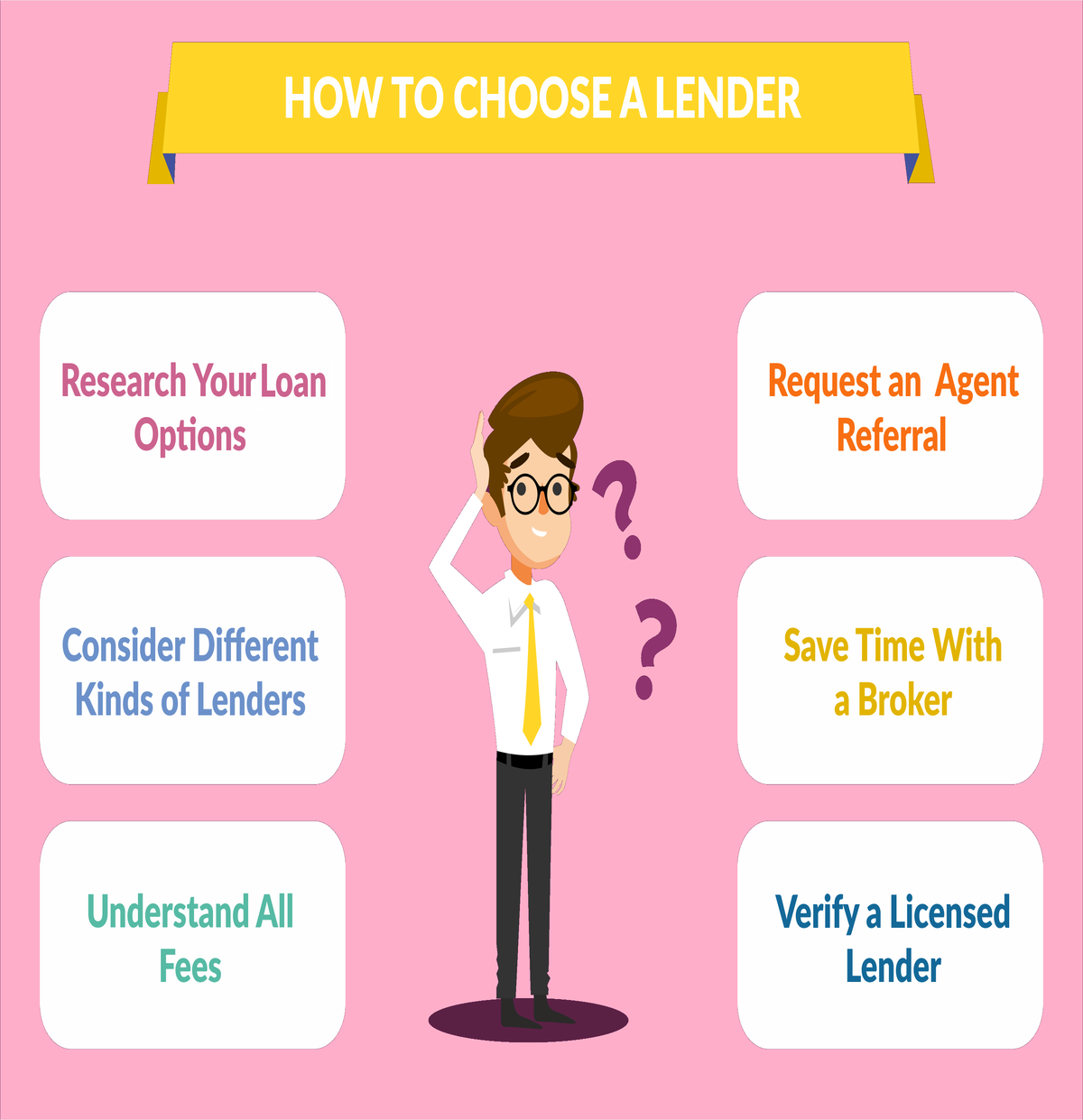

One of many most important advancements in the lending trade is the shift towards more inclusive credit score evaluation methodologies. Conventional credit score scoring methods primarily rely on FICO scores, which will be restrictive for people with limited credit histories or previous monetary missteps. In contrast, many lenders are actually adopting alternative credit score scoring fashions that consider a broader range of factors.

These various models can include fee histories for rent, utilities, and even subscription providers, offering a more comprehensive view of a person's financial behavior. By leveraging knowledge from non-traditional sources, lenders can higher assess the creditworthiness of borrowers with dangerous credit score, finally resulting in more favorable loan terms.

The Rise of Fintech Options

The rise of financial know-how (fintech) firms has further revolutionized the panorama of lengthy-term personal loans for bad credit. Fintech lenders often make the most of advanced algorithms and machine learning to streamline the lending process, making it sooner and more efficient. These firms can rapidly analyze huge quantities of data to evaluate credit danger, which permits them to offer loans to people who might have been ignored by traditional banks.

Moreover, many fintech platforms present a user-pleasant on-line expertise, enabling borrowers to apply for loans from the consolation of their homes. If you liked this posting and you would like to obtain far more facts relating to quick unsecured personal loans bad credit (sun-clinic.co.il) kindly stop by the web-page. This accessibility is particularly beneficial for those with unhealthy credit, who could feel intimidated by the standard banking setting. The transparency and convenience of fintech options are empowering borrowers to take management of their monetary futures.

Versatile Loan Phrases and Situations

Another notable development in lengthy-time period personal loans for bad credit is the growing flexibility of loan terms and situations. Lenders are beginning to acknowledge that borrowers with poor credit might have distinctive financial situations that require tailor-made options. In consequence, many lenders are providing customizable loan options, allowing borrowers to pick repayment phrases that align with their monetary capabilities.

For instance, some lenders now present the option to adjust month-to-month payment quantities or extend the loan time period if a borrower encounters financial difficulties. This flexibility might help borrowers keep away from default and handle their debts more effectively, in the end leading to improved credit scores over time.

Peer-to-Peer Lending Platforms

Peer-to-peer (P2P) lending platforms have emerged as a viable various for individuals in search of long-term personal loans with bad credit score. These platforms join borrowers immediately with individual traders who're prepared to fund their loans. As a result of P2P lending bypasses conventional financial establishments, borrowers usually discover extra lenient credit requirements and aggressive curiosity charges.

Furthermore, P2P lending permits investors to diversify their portfolios by funding loans to a range of borrowers, together with those with dangerous credit score. This model not only supplies entry to capital for borrowers but in addition allows buyers to assist financial inclusion efforts and probably earn returns on their investments.

Monetary Education and Assist

In addition to offering access to loans, many fashionable lenders are prioritizing financial training and help for borrowers with unhealthy credit score. Recognizing that financial literacy is a vital part of long-term monetary well being, some lenders are providing resources equivalent to budgeting tools, credit score counseling, and customized financial recommendation.

These initiatives empower borrowers to make knowledgeable selections about their funds, helping them understand the implications of taking on debt and learn how to handle it effectively. By equipping borrowers with the data and abilities needed to improve their monetary situations, lenders are fostering a tradition of responsible borrowing.

The Impression of Regulatory Modifications

Regulatory adjustments have additionally played a task in advancing long-term personal loans for bad credit. Lately, regulators have launched measures geared toward promoting fair lending practices and lowering discrimination within the credit score market. These adjustments have inspired lenders to adopt extra inclusive lending practices, ultimately benefiting borrowers with unhealthy credit.

For instance, the introduction of rules that require lenders to think about an applicant's skill to repay a loan slightly than solely relying on credit score scores has opened the door for more people to entry credit. This shift is especially important for many who could have experienced non permanent monetary setbacks but are now in a position to manage their debts responsibly.

Conclusion: A Brighter Future for Borrowers

The advancements in lengthy-time period personal loans for bad credit signify a promising shift in the direction of better financial inclusion and accessibility. By embracing various credit score assessments, leveraging fintech improvements, providing versatile loan phrases, and prioritizing monetary training, lenders are making a more equitable lending panorama.

As these trends continue to evolve, borrowers with dangerous credit score can stay up for a future the place entry to credit shouldn't be solely decided by previous financial mistakes. Instead, the focus is shifting in the direction of understanding particular person circumstances and providing tailor-made solutions that empower borrowers to rebuild their financial lives. With these advancements, the dream of attaining monetary stability and safety is changing into more and more attainable for those who have faced challenges previously.