India’s blue-collar workforce—over 450 million strong—powers factories, construction sites, logistics, retail, and the gig economy. Yet, paying them accurately and compliantly remains a nightmare for most employers. Manual registers, cash envelopes, Excel chaos, and statutory delays lead to disputes, penalties, and high turnover.

Enter Payroll Software in India purpose-built for blue-collar realities: daily wages, shift allowances, overtime, geo-fenced attendance, biometric sync, and instant UPI payouts. This 2000-word guide explores every angle—challenges, must-have features, top solutions (including TankhaPay), implementation steps, ROI math, and future trends—so you can pay your workers right, every time.

The Blue-Collar Payroll Puzzle: Why It’s Different

Unlike white-collar salary structures, blue-collar payroll is variable, fragmented, and hyper-local. Consider these realities:

| Factor | Blue-Collar Reality | Payroll Impact |

|---|---|---|

| Wage Type | Daily, weekly, piece-rate | Requires real-time calculation |

| Attendance | Shift-based, multi-site, outdoor | Needs geo-fencing + biometrics |

| Overtime | Frequent, rule-based (Factories Act) | Auto-calculation mandatory |

| Statutory | PF, ESI, Bonus, Gratuity | Threshold-based, state-specific |

| Diversity | Multilingual, low digital literacy | Vernacular UI + voice/SMS |

| Disbursement | Cash or UPI preference | Instant bank transfer critical |

A 2024 NSSO report reveals 68% of blue-collar workers change jobs due to delayed or incorrect wages—costing Indian industry ₹82,000 crore annually in recruitment and training. Payroll Software in India fixes this at the root.

Core Challenges in Blue-Collar Payroll (And How Software Solves Them)

1. Attendance Tracking Across Sites

Problem: Workers punch in at factories, warehouses, or remote sites. Paper muster rolls = proxy, ghost entries, disputes. Solution:

- Geo-fenced mobile check-in (radius 50–500 m)

- Facial recognition + selfie verification

- Bluetooth beacon integration for indoor plants

- Offline mode with auto-sync

Example: A Mumbai construction firm reduced proxy attendance by 94% using geo-fencing.

2. Variable Pay Components

Problem: Basic + DA + HRA + Shift Allowance + Overtime + Incentives = Complex Excel formulas. Solution:

- Rule engine for auto-calculation

- Piece-rate modules (e.g., ₹2 per brick laid)

- Shift roster integration

- Real-time gross pay preview

3. Statutory Compliance Without Registration Hassles

Problem: PF/ESI mandatory above 10/20 employees, but registration takes 30–60 days. Non-compliance = ₹50,000+ fines. Solution:

- Employer of Record (EOR) services (more on TankhaPay below)

- Auto PF/ESI deduction even for <20 employees

- One-click ECR generation for EPFO

4. Cash-to-Digital Transition

Problem: 62% blue-collar workers prefer cash; banks far, literacy low. Solution:

- UPI salary credit in 2 seconds

- Prepaid card integration

- ATM cash-out via partner networks

- SMS payslips in Hindi, Tamil, etc.

5. Dispute Resolution & Transparency

Problem: “Boss cut my overtime!” → Strikes, IT cell visits. Solution:

- Worker mobile app (view payslip, raise query)

- Audit trail for every deduction

- Grievance ticketing with 24-hr resolution SLA

Must-Have Features in Blue-Collar Payroll Software in India

| Feature | Why It Matters | Example Use Case |

|---|---|---|

| Geo-Fenced Attendance | Prevents buddy punching | Construction site in Pune |

| Biometric Sync (Face/Finger) | Works with dusty hands | Factory shop floor |

| Daily Wage Engine | Auto-calculates present days | Contract labor |

| Piece-Rate Module | Pay per output | Garment stitching |

| Shift & Overtime Rules | Factories Act compliance | Night shift allowance |

| EOR Compliance | PF/ESI without your code | Startups <20 employees |

| Vernacular UI | Hindi, Tamil, Bengali, etc. | Pan-India workforce |

| UPI Payouts | Instant salary credit | Gig delivery riders |

| Offline Mode | Remote sites, no WiFi | Rural warehouses |

| Worker App | Payslip, leave, query | Low-literacy access |

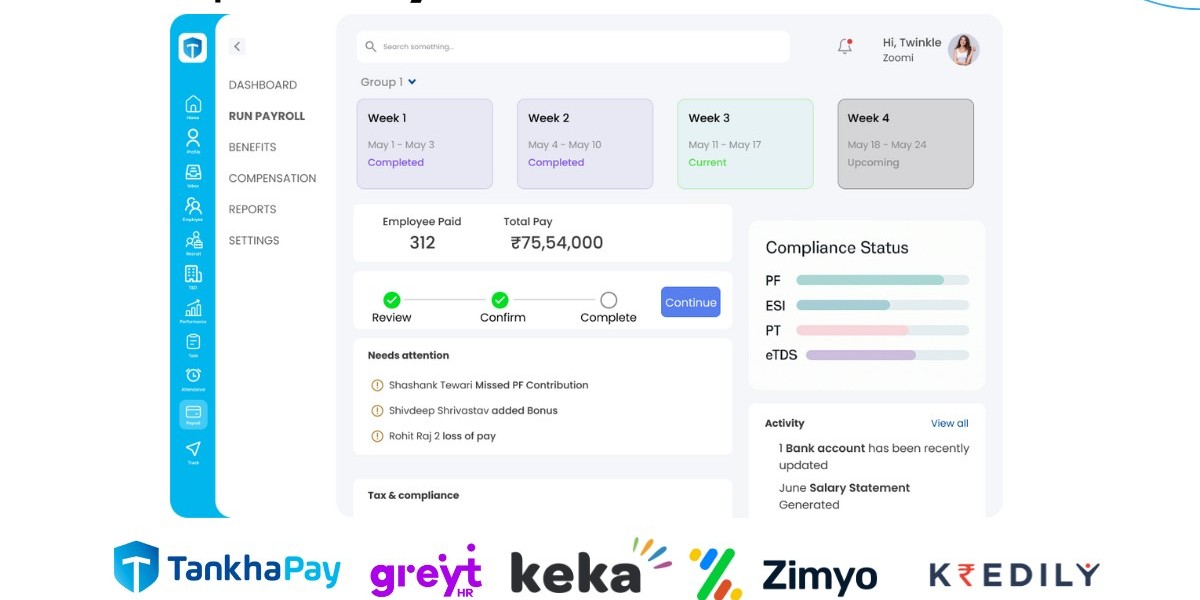

Top 7 Payroll Software in India for Blue-Collar Workforce (2025)

1. TankhaPay – The EOR Champion

Best For: MSMEs, factories, construction, staffing agencies

Why It Stands Out:

- EOR Model: Provide PF, ESI, bonus, gratuity without your own registration

- Geo-fenced + facial attendance with offline sync

- Daily wage + piece-rate engine

- UPI payout in <2 sec

- Worker app in 8 languages

- 100% compliance guarantee (or they pay the fine)

Clients: 1,000+ businesses, 50,000+ workers Pricing: Custom (EOR starts ~₹99/employee/month) Rating: 4.7/5

Case Study: A Noida electronics factory saved ₹14 lakh/year in PF setup + penalties using TankhaPay’s EOR.

2. factoHR

Best For: Manufacturing units with 100–5,000 workers

Features:

- Beacon-based indoor attendance

- Shift rostering + auto-overtime

- Shop floor kiosk mode

- TDS, PT, LWF state-wise

Pricing: ₹35–₹90/employee/month Rating: 4.5/5

3. greytHR

Best For: Traditional factories needing statutory depth

Features:

- 100+ compliance reports

- ECR 2.0 ready

- Bonus module

- Worker self-service portal

Pricing: ₹3,495 base + ₹35/employee Rating: 4.6/5

4. Keka

Best For: Modern plants with mixed workforce

Features:

- AI attendance anomaly detection

- Incentive workflows

- SMS payslips

- Tally integration

Pricing: ₹6,999 for 100 employees Rating: 4.8/5

5. Zoho Payroll

Best For: Small factories (<50 workers)

Features:

- Free for <10 employees

- UPI + bank transfer

- Form 16 auto-gen

- Regional language support

Pricing: ₹40/employee/month Rating: 4.5/5

6. RazorpayX Payroll

Best For: Logistics & gig fleets

Features:

- Instant UPI salary

- Fuel reimbursement workflows

- Driver rating sync

- Insurance integration

Pricing: ₹99/employee/month Rating: 4.7/5

7. Pocket HRMS

Best For: Western India manufacturing clusters

Features:

- Biometric device sync (eSSL, Biomax)

- Piece-rate + incentive

- Marathi/Gujarati UI

- Local support offices

Pricing: ~₹30/employee/month Rating: 4.4/5

Deep Dive: How TankhaPay Solves Blue-Collar Payroll (Real Example)

Client: Shri Ram Textiles, Tiruppur (1,200 workers) Challenges:

- 3-shift roster, piece-rate stitching

- 40% workers < PF threshold

- Manual PF/ESI filing → 3-month delay

- Cash payment disputes

TankhaPay Implementation:

- Day 1: Onboarded via CSV + Aadhaar e-sign

- Day 3: Geo-fencing at factory gates + facial kiosks

- Day 7: Shift rules configured (₹350 basic + ₹2 per shirt)

- Day 10: First payroll run → UPI credit by 6 PM

- Ongoing: EOR handles PF/ESI; workers get app in Tamil

Results (6 months):

- 98% on-time payroll (vs 62%)

- Zero compliance penalties

- 22% lower turnover

- ₹9.2 lakh saved in admin + fines

Step-by-Step: Implementing Payroll Software for Blue-Collar Teams

Phase 1: Discovery (1 week)

- Map wage components (basic, DA, incentives)

- List sites & attendance methods

- Count workers above/below PF-ESI threshold

Phase 2: Vendor Selection (2 weeks)

- Shortlist 3 tools (use table below)

- Request live demo with your data

- Check vernacular + offline support

Phase 3: Pilot (1 month)

- Run with 50–100 workers

- Train supervisors via video (Hindi/Tamil)

- Collect feedback via worker app

Phase 4: Full Rollout (2 months)

- Migrate all workers

- Integrate biometric devices

- Set UPI mandate with fallback cash

Phase 5: Optimize (Ongoing)

- Monthly compliance audit

- Worker satisfaction NPS

- Incentive vs output analysis

ROI Calculator: Payroll Software vs Manual

| Metric | Manual | Software (TankhaPay EOR) | Savings |

|---|---|---|---|

| Admin Time | 160 hrs/month | 20 hrs/month | 140 hrs |

| Error Cost | ₹45,000/month | ₹2,000/month | ₹43,000 |

| Compliance Fines | ₹1,00,000/year | ₹0 | ₹1,00,000 |

| Turnover Cost | ₹12 lakh/year | ₹9.4 lakh/year | ₹2.6 lakh |

| Total Annual Saving | — | — | ₹7.59 lakh (for 200 workers) |

Assumptions: ₹400 avg daily wage, 12% error rate, 18% turnover

Legal Compliance Checklist for Blue-Collar Payroll

| Law | Applicability | Payroll Software Role |

|---|---|---|

| Payment of Wages Act | All | Digital wage register |

| Minimum Wages Act | State-wise | Auto daily rate update |

| Factories Act | ≥10 workers with power | Overtime @2x after 9 hrs |

| PF Act | ≥20 employees | EOR for <20 |

| ESI Act | ₹21,000 wage ceiling | Auto deduction |

| Bonus Act | ₹7,000–₹21,000 | 8.33% auto-calc |

| Gratuity Act | 5+ years | Accrual tracking |

Pro Tip: Use software with built-in labor code engine—updates automatically when Tamil Nadu raises minimum wage.

Future of Blue-Collar Payroll Software in India (2026–2030)

- AI Predictive Attendance → Forecast no-shows using weather, festival data

- Blockchain Wage Ledger → Immutable payslip; workers own their wage history

- Gig-to-Permanent Pathways → Convert daily wager to PF-enrolled in one click

- Wearable Sync → Smart helmets log hours on site

- Voice Payroll → “Alexa, kya salary aayi?” in Hindi

- Carbon Payroll → Bonus for carpooling to factory

FAQs: Payroll Software for Blue-Collar Workers

Q: Can software handle cash-preferred workers? A: Yes—UPI to Jan Dhan, prepaid cards, or partner cash-out points.

Q: What if internet fails at remote sites? A: Offline mobile app stores punches; syncs when signal returns.

Q: Is EOR legal? A: 100%—TankhaPay is registered PF/ESI principal employer.

Q: How to train low-literacy workers? A: 2-min video in regional language + supervisor demo.

Q: Can one software manage factory + gig riders? A: Yes—TankhaPay, RazorpayX support both.

Conclusion: Pay Right, Retain Talent, Grow Fearlessly

Your blue-collar workforce isn’t a cost center—it’s your competitive edge. Payroll Software in India designed for daily wagers eliminates disputes, ensures compliance, and boosts morale.

From TankhaPay’s EOR magic to factoHR’s shop-floor precision, the tools exist. The only question: Will you keep losing lakhs to manual errors—or invest ₹50/employee/month to save crores in efficiency?